Giving Credit Where Credit is Due

“Stop revolving between attribution, validation and attention. Start settling into compassion.”

― Nitya Prakash

With the stock market reaching all time highs, the global pandemic uprooting our livelihood, increasing social unrest, and an even more uncertain future, we may be looking over the things we have and maybe don’t have to help us feel more secure. For some, it’s adapting to this new environment by building new skills or using the ones you already have to create value for others and work for yourself. For others, you may wonder whether your investments are enough to create financial freedom so you no longer have to do this. For many, feeling secure in this new realm is the goal. Getting there may be a challenge, but with a good understanding of where you are and what you want, you can make it happen. If you are a client, we are on this journey together.

When we say Heintz Wealth takes a personalized approach to managing your wealth, this means a few things, in order. First, we take a detailed look at your resources and what already own. Next, we manage your investments toward a targeted mix of holdings that is designed by us with the help of our network of expert resources. We then oversee these holdings, making adjustments to express more or less in certain areas of the market. More often, we are buying or selling based on your own needs, whether you are building up your nest egg or are relying on your wealth for income. For many, our role is to create your own personal pension, by providing you the security you won’t run out of money before you run out of breath. This involves a more complex look across multiple accounts, including retirement accounts and other investment accounts. The objective, as we say is “It’s not what you make, it’s what you keep.”

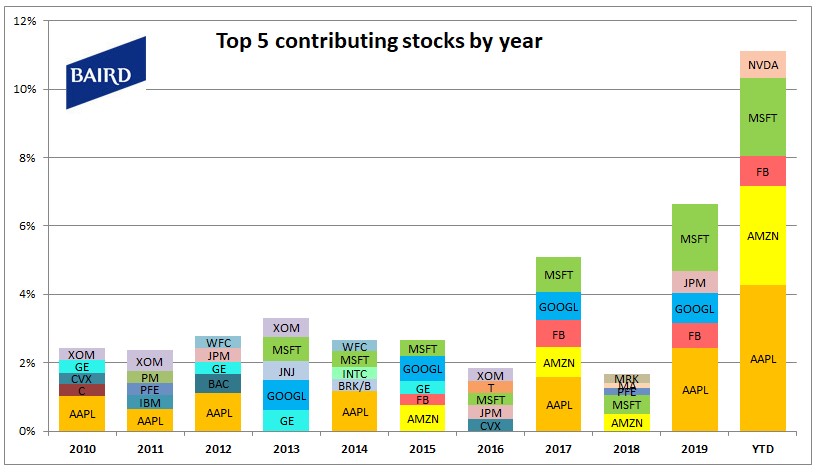

From time to time, we take a look under the hood to see what’s inside you portfolio. Our primary goal is to align the amount of risk you are willing and can afford to take with what you own. We look at what attributes to the overall return of your portfolio, whether they are above or below where you are targeted to be. Lately, there is a lot of focus here as the stock market’s returns can be attributed to just a few names. A few, but very large companies did a tremendous amount of heavy lifting in 2020 to contribute to the stock market’s highs this year.

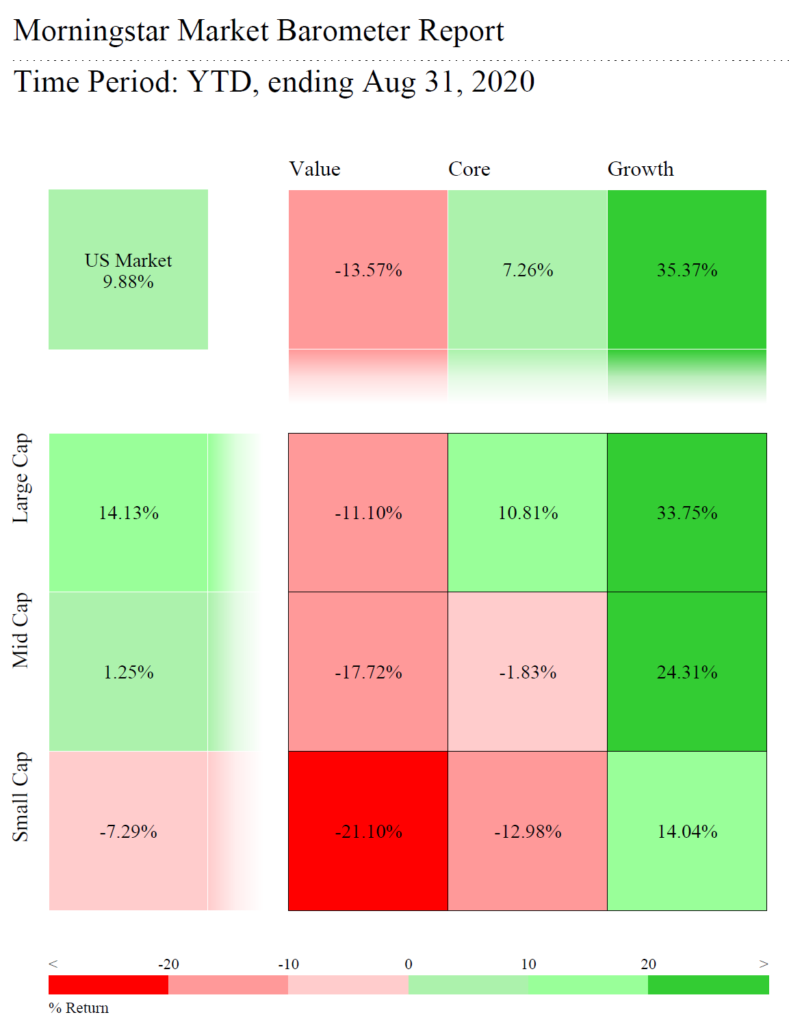

These five names, Apple, Amazon, Facebook, Microsoft, and Nvidia, make up a large amount of the stock market both in terms of their market valuation and their growth year to date, contributing about 11% to the overall return to the S&P 500. The overall market, however is up less than this. If you take a look at the Morningstar Style Box returns, large cap growth is dominating the returns for the year.

So what does this mean where you should invest? More importantly, how does this impact your overall financial plan? Some of you may be experiencing FOMO, or the fear of missing out, and just want to hop on a rally that doesn’t seem to want to end. For others, there is a concern that this time may truly be different. And for most, you may not even be focused on these shifts in the market, but just want to know what impact it has on you. We are constantly watching the moves in the markets to understand how the psychology and fundamentals cause its change in direction. From a planning perspective, it helps to attribute, validate, and give attention to what and why something is happening, but at the end of the day, how it affects your financial situation is key. Setting up a separate account for “play money” in an investment that is the next big thing could be a solution if you have FOMO. Or staying the course with your overall plan knowing these investments have too much risk for you could be the best solution. There is no right answer, but through understanding we can determine the best course of action.